FWIW # 50 - Important Signals

Posted by Eugene Kelly(E. Aly) on Jul 2nd 2025

Well, the stock market is close to an all-time high, interest rates are falling, and Congress is about to pass legislation to make cryptocurrencies, at least stablecoins, legitimate. Life is wonderful, isn’t it?

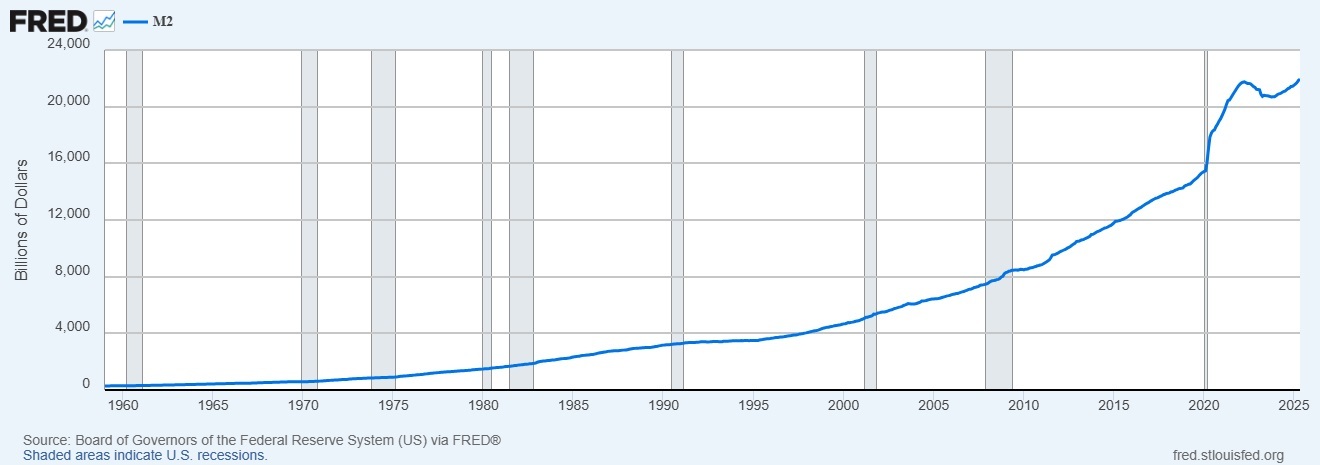

Many analysts and financial pundits believe the thanks goes to the Trump administration. For sure, the president has a way of convincing people that he is the guiding star in the areas of economics and finance. That is a contributing factor to the current optimism; however, the chart below is also a major factor in a robust economy.

This is a chart of M2 as of May 1, 2025. While the numbers are too small to read, the shape of the line is what is important. See the first peak on the far right? That’s the M2 money in the monetary system at the height of the inflationary spiral. It was $21,749.9 trillion. Inflation dropped when the Fed reduced the money supply and raised interest rates. By October 2023, inflation had moderated, in large part because of the drop in M2 to a level of $20,687.6 trillion. Now, with President Trump badgering the Fed about cutting interest rates, the Fed has been doing what they should: resuming M2 money supply growth. In May 2025, M2 was at $21,942 trillion, above the level of liquidity during the time inflation was raging. Nevertheless, manipulation of the money supply, with the outsized growth in 2020 and 2021 and the steep drop in 2022 and 2023 rather than a steady, appropriate increase, is a signal that monetary authorities are still working closely with the federal government in suppressing interest rates. The Fed is doing what President Trump wants, but not the way he wants. Examining the trend prior to 2020 and extending it to now shows the current M2 amount is still above that extended trend.

Make no mistake about it: Suppressed interest rates hurt creditors and investors while, in many cases, helping borrowers and speculators make bad business decisions based on distorted economics. Witness the more than a decade of suppressed interest rates during the period after 2009. While it’s unlikely to happen anytime soon, markets, without the influence of politics or monetary authorities, should set interest rates. If governments and the private sector had to pay market-set interest rates, the impact of deficit spending and bad investments would act as a modifying mechanism. There is another problem with suppressed interest rates. Today’s US Treasury market is distorted and fragile due to speculators using huge amounts of leverage when positioning Treasury securities. These speculators believe the Fed and president will always step in and suppress interest rates. This is a prescription for a financial crisis.

***

Past FWIWs have addressed cryptocurrencies, including stablecoins. The Senate passed the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act) two weeks ago. It will now go to conference with the expected House version, and a final bill will be signed by the president. I won’t go through the explanation of crypto I gave before, but I will remind everyone that a stablecoin is not stable, nor is it a coin. Go back in history to 1785 through 1935, and you’ll see that several currencies were issued by individual banks as well as by the federal government. We are about to enter a similar period since banks and some approved non-bank fintech companies will be able to issue their own stablecoins. Always remember the maxim: Bad money drives out good money.

***

The stock market reached a record high last week. The stock market makes all of us look like geniuses, and we didn’t need an act of Congress to tell us so. No one knows what will happen in the stock market’s future. It’s a good bet that the Wall Street trading desks will do their best to create more volatility, like last April’s decline, so they can boost their trading profits. What about those of us who aren’t traders, just investors looking for fair opportunities to own stocks for the long term? A portfolio should fit the investor’s financial and psychological perspectives. The market today is dominated by passive speculators and investors who just plunk their money into their favorite index ETF and mutual fund, expecting fabulous wealth to materialize. In doing so, they are essentially riding with the market favorites at the time, thinking of investing as essentially accepting whatever value most market speculators believe will be the future. That works until it doesn’t. It also ensures that some poorly run companies in the indices are in the portfolio.

The reasons for passive investing are given as (1) it’s cheap, saving the supposedly enormous fees of investment managers, and (2) no one can pick stocks that will outperform the indices over time. That perspective is flawed in several ways. I’ll only mention two.

First, the yield on the S&P 500 is currently 1.27%. A portfolio of companies selected using the equity strategy in 19 Rules for Getting Rich and Staying Rich Despite Wall Street has a dividend yield over 3%. Over a ten-year period, the cash flow from dividends in the 19 Rules portfolio will be twice that in the passive index. That essentially means the 19 Rules portfolio will have twice as much cash flow to invest in the best opportunity at the time the cash is available. Thus, the opportunity to compound the returns is greater. One of the investment principles overlooked by market participants is investing every year in whatever opportunities are available. Good investors don’t just ride the market momentum; they use their investment income to add future opportunities when available.

Second, when a company’s stock is added to the 19 Rules portfolio, it’s at a fair price, not an inflated price as happens when the indices change their member companies. If you study the changes in the S&P 500 over time, the committee making the changes seems to always be dropping a company that has been in the doldrums for a period in exchange for one that has experienced (and is experiencing) stock price momentum. Buying high and selling low doesn’t make sense over time.

There is more to say about passive index investing, but that’s for a later date. The biggest argument some have with the 19 Rules method is that it doesn’t emphasize non-dividend-paying stocks. This is true, but that doesn’t mean they aren’t in the portfolio. Several of the market leaders today were laggards ten or fifteen years ago, and they paid small or no dividends at that time. By matching a non-dividend-paying good company bought at a fair price with another good company in another sector that pays an attractive dividend, you can add potential high-growth companies to the portfolio without missing the yield objective.

There is another attractive aspect of the 19 Rules strategy. Today, with the stock market at all-time highs, money has shifted away from good companies with steady but low growth potential, depressing these stocks’ prices. Many are established, dividend-paying companies with yields of 3% or more, selling goods and services to hundreds of millions of people. The Excel spreadsheets used in the 19 Rules strategy clearly distinguish the best of these companies. A quick example will highlight this situation. This information is not an endorsement or criticism of any of these companies, just an example of the market structure today (prices are as of the close of business June 27, 2025). MSFT has a market capitalization greater than the combined market capitalizations of these companies:

ADM TR INGR MRK

BF/B FLO SYY OGN

CAG PEP CHD VTRS

CPB PM EL GEHC

HSY CL AMGN BDX

KHC CLX ABBV TMO

KMB GIS ABT CGC

KO MKC BMY ZBH

MDLZ K CAH

PG HRL GILD

SJM BG JNJ

I want to repeat, this is not a condemnation of MSFT or a recommendation of any of these companies. I only point out that an investor can find fair value in multiple companies, even when the stock market indices are at all-time high prices.

One last point: For multiple years, 2001 to 2013, MSFT could have been bought for under $26 using the principles of 19 Rules. The current dividend on MSFT would be at least a 12% annual return on the original investment during these years. Which of these 42 companies have an opportunity to perform well in the future is unknown, but an investor could have above-market cash flow to reinvest while patiently owning a good company bought at a fair price.