FWIW #43 - Various Thoughts

Posted by Eugene Kelly(E. Aly) on Jun 28th 2024

It’s been a while since the last FWIW, primarily due to my fatigue from writing about the Fed and inflation. The sanctimonious comments that the Fed is independent from political influence are why I’ve written this FWIW. The Fed is not, never has been, and never will be apolitical. The following charts drive home two key facts: (1) the Fed is not independent and (2) the Fed knows it influences elections and is still doing what is necessary to influence the current election.

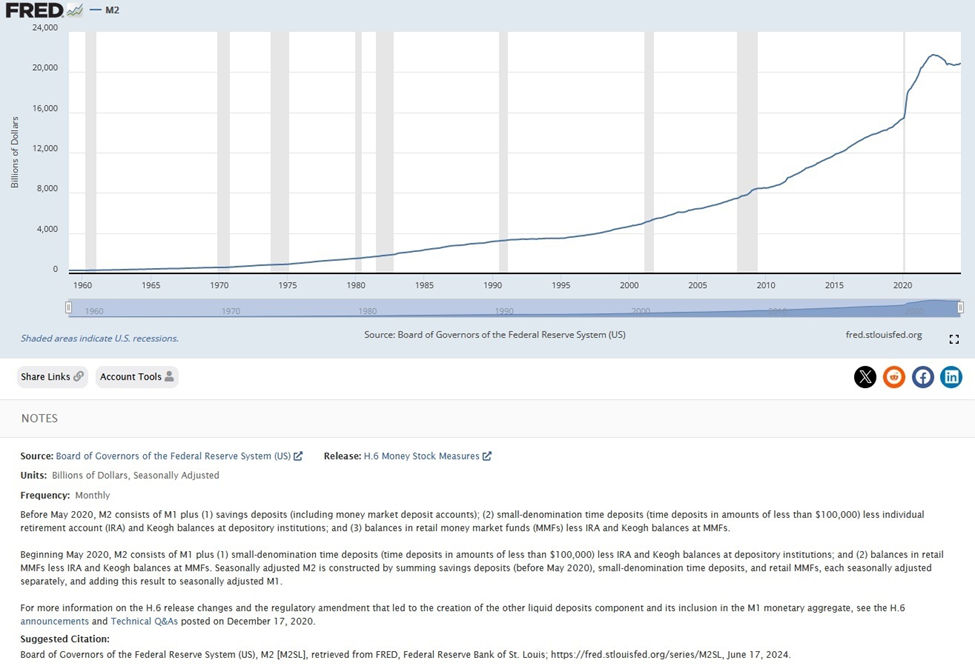

The first chart shows the principal money supply, M2. The numbers are not as important as the shape of the line indicating the growth of M2 over the years, but they do tell a story since 2008, particularly in 2020, 2022, and now 2024.

Just so you can see not only the actual change in the slope of the line but also the deliberateness of the Fed’s actions, understand the following timeline of M2:

Late 2007, before the Great Recession: $7,729.9 billion

February 2020: $15,432.3 billion (Pandemic beginning)

May 2022 (the peak): $21,691.3 billion

April 2024 (latest measurement): $20,867.3 billion

Notice how a policy change shrank the M2 quickly in late 2022 and early 2023, but it has now leveled off, slightly higher than the low in October 2023 ($20,691.7 billion) but still massive given the pandemic is long over. Is the latest uptick in M2 from October 2023 a signal the Fed is willing to resume accepting inflation at current levels or even higher? It could be, but the M2 money supply is not the whole story.

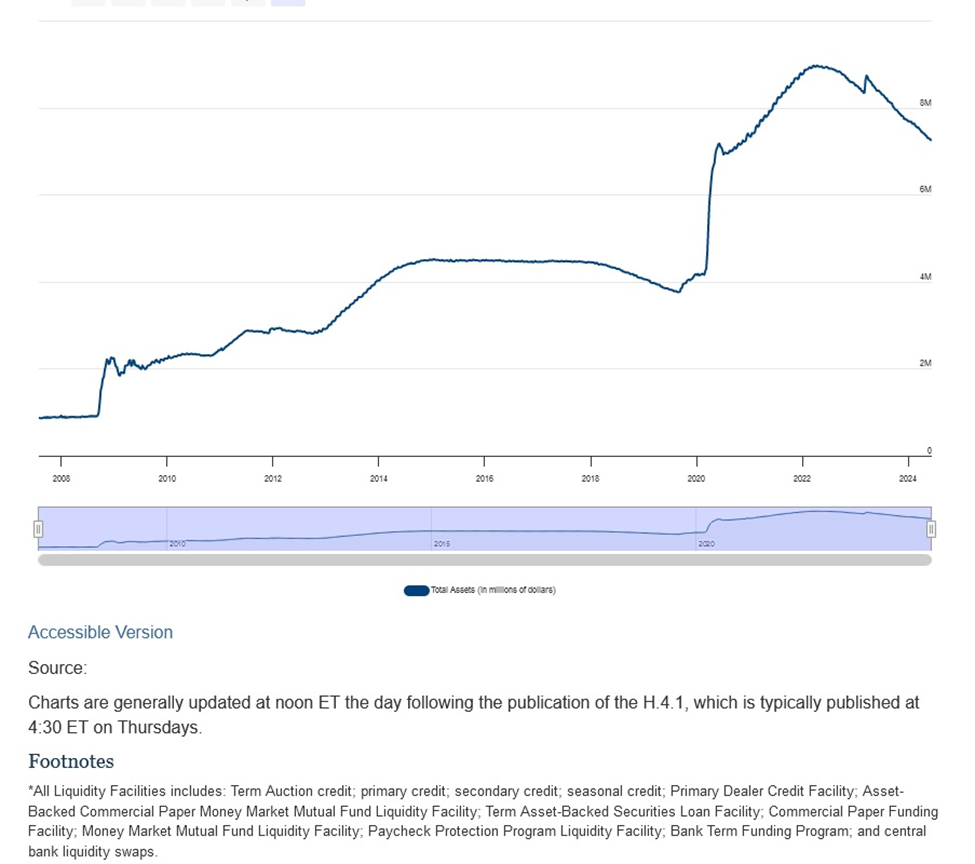

This chart shows how the Fed was willing to respond to the wishes of the political leaders in Washington. The far left of the chart starts in 2008, when the size of the Fed balance sheet was $890.662 billion. The Fed, through its unprecedented quantitative easing (QE) policies, grew its balance sheet to $4,480.426 trillion through the year 2016 and the presidential election. Between 2017 and the end of 2019, the Fed balance sheet declined to $3,769.673 trillion. Then came the pandemic. In six months, it jumped to $7,165.217 trillion. After 2021, with most of the questionable pandemic responses in the past, the Fed continued to cater to political leaders by increasing its balance sheet to accommodate wealth redistribution fiscal policies until a peak was reached in late 2022 with a total of $8,962.479 trillion. Grappling with the electorate’s uproar about the rise in uncontrolled inflation, the Fed reduced the balance sheet to $7,299.566 trillion. This size still incorporates the huge increase that resulted from responding to the pandemic.

If you look at both charts, one glaring aspect is clear. While the Fed has made some preliminary policy changes to placate the electorate’s anxiety concerning inflation, it has not continued on a path that will reduce inflation to its 2% professed target. In both the money supply and the balance sheet, it appears policy at the Fed has brought inflation down from its peak, but there are no indications Fed policies will continue to reduce the inflationary money supply and balance sheet sizes. On the contrary, it appears the Fed is just waiting until after the election to return to the inflationary policies started in 2008. Keep in mind, the political authorities have a vested interest in maintaining inflation as high as is possible without an electoral backlash. The announcement by the Fed chairman last week that there will be a rate cut before the end of the year sent interest rates lower. The announcement was as good as a cut now, and the action coming four and a half months before the election should give anyone who professes the Fed’s political independence some cause for rethinking.

Some of my critics say I’m unfair to the Fed and its political masters because the actions taken in 2008 and again in 2020 were necessary to avoid a massive economic depression. I disagree. If the Fed had maintained an acceptable trendline growth of the money supply and, at the same time, allowed interest rates to reflect the market’s value of money and liquidity, both the public and private sectors would have understood the true cost of money and made economic decisions while fully aware of their implications. Instead, “free” money became the mantra after 2008, distorting investment decisions, and that distortion continues even today. Market analysts can speak all they want about this rally being earnings-driven and a result of AI and GAI, but the fact remains the excess liquidity sloshing around in the economy is finding its way into investment markets and continuing to distort valuations. Is that a bad thing? Not really; it’s just a fact. An investor looks at facts, not at whether they’re good or bad but at reality. That’s why it’s important to buy companies at a fair valuation and not let your own fear and greed or the media and Wall Street influence you into selling the company.

No one knows how long inflation will be elevated. The longer it’s at current or higher levels, the more it will eventually move through the income statements and balance sheets of your companies. Be thankful you own economic entities that will help you overcome the impact of inflation in your life.

The Fed’s distortion of investment value since 2008 is coming home to roost. While the Fed has much blame to shoulder, so-called professional investors who run massive pension plans and foundations are proving their professional competence should be questioned. In the era of “free” money, private equity and venture capital salespeople touted the extraordinary returns available in the private markets. They acknowledged these higher returns were partly due to the illiquidity of these investments. The time horizon in private equity and venture capital is usually between seven and twenty years. These pension and foundation managers, supposedly knowledgeable investors who understand their portfolios and cash needs, and their consultants heard the siren song of above-average returns and joined the craze.

But now interest rates are higher, the private equity and venture capital markets are truly illiquid, and many of these managers have overcommitted to alternative investments. Cash obligations are forcing them to sell the long-term illiquid speculations at steep discounts from their current values, which are far less than their expected longer term values. How can these “professional” investment managers keep their jobs? They should have learned their first year in finance that illiquid investments must carry a higher return, and even that higher return is not guaranteed. The real smart investors are the ones buying these positions at steep discounts. The truly sad aspect for the retirees is similar returns could be achieved in the public markets with less risk for long-term investors.

While I’m wandering around in Alice in Wonderland territory, I thought I would bring to your attention an article published in the Financial Times the week before last, entitled “US Urges EU to Delay Deforestation Law.” This is a classic example of just how far the unelected bureaucrats’ illogical thought process has gone regarding climate change. Essentially, the EU says that importers of any cocoa, timber (including furniture), and even sanitary products must be able to prove these products did not result in deforestation anywhere in the world. Not only must the shipper (importer) sign an oath to that effect but they must also give geolocations for the origin of the source material, including the wood chips used to produce the sanitary products (diapers, incontinence pads, menstrual pads, and adult diapers). Technology for identifying the origins of a mix of wood chips from different locations does not exist. If this law is enacted and enforced, it will only benefit EU organized crime, whose leaders will develop an underground market for these products.

All the money the climate change advocates are wasting on illogical laws and mandates raises the question: Why don’t the politicians and bureaucrats push to have more trees planted instead of throwing money after actions that either won’t work or will work only in the sun or wind? Did you know a mature tree absorbs 48 pounds of CO2 from the air per year? Someone has estimated it would take a trillion trees to offset global warming. That’s a lot of trees! Is that possible? Did you know that around the globe, it’s estimated there are over 3 trillion trees today? Makes planting another trillion seem doable. Even if only half that many were planted, it would make more of an impact than all the electric vehicles being mandated today. Climate change and the various billions being spent by governments have nothing to do with saving the planet. It’s all about politicians and ultra-wealthy activists developing and exercising their own political and economic power. In case you’re interested, bamboo, particularly the large Asian type, is a great CO2 absorber.

Finally, three thoughts:

- 1.Appeasement of enemies, Russia and Iran, has never worked and will not work today. History will eventually record the shamefulness of the US government and its war-loser mentality. Think through the essentials that may disappear when appeasement finally leads to calamity. Congress is working on updating the draft laws right now. What they can’t agree on is drafting women.

- 2.There has never been a currency created and issued by a non-government entity that maintained its worth throughout the ages. Why do 52 million speculators believe it will be different this time?

- 3.Don’t blame President Biden for his debate performance. Blame the Democrat Party leadership for their putting their power ahead of the country’s security.